Handy Advice On Picking Credit Card Apps

Wiki Article

How Do I Determine Whether My Credit Card Was Identified As Stolen In The Us?

Follow these steps: 1. Contact the credit card company that issued your card.

Call the copyright on the back of your credit card.

Inform the representative that would like to confirm the validity of your credit card and whether it has been reported stolen or lost.

Get your personal information ready as well as the details of your credit card to be verified.

Check Your Online Account

Log in to your online banking or credit card account that is linked to the card at issue.

Look for any alerts, notifications or messages concerning the status of your credit card.

Examine the latest transactions to find suspicious or illegal activity.

Check Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com.

Check the report for unusual credit accounts or inquiries that might indicate fraud.

Fraud Alerts & Security Freezes

If you suspect fraud or identity theft, think about applying a freeze on your security or a fraud alert on your credit report.

A fraud alert notifies creditors to take extra steps to confirm your identity before extending credit. A security freeze blocks access to your credit report.

Report any suspicious activities that are suspicious.

Make sure you report any suspicious transactions or unauthorized purchases to your credit card issuer.

Report any suspected cases for investigation to the Federal Trade Commission. You could also file a claim with your local law enforcement agency.

Contacting your credit card issuer and reviewing your account's activity online, observing your credit report, and watching out for evidence of fraud You can take proactive steps to protect yourself from fraud on credit cards and resolve any issues with the reported theft of your credit card.

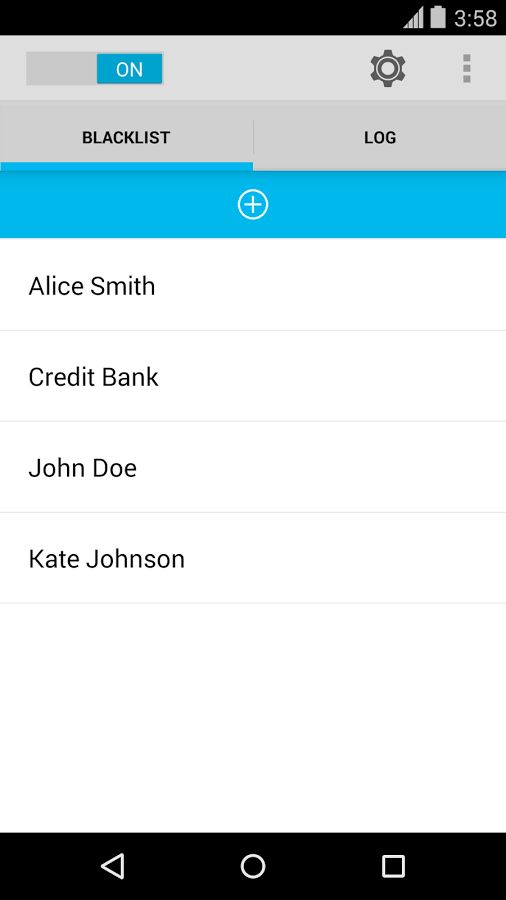

What Does It Mean For My Credit Card To Be Placed On A Blacklist?

A credit card listed on"a "blacklist" is one that is flagged by the issuer, financial institution, or both due to the possibility of fraud, security concerns or other risk factors. The card could be put on the "blacklist" for a variety of reasons. These include:

Suspected Fraud - Unusual or suspicious transactions made on the card that are detected as fraud could cause the card to be restricted to protect the card.

Security IssuesIf there are signs of potential compromise for example, an unauthorised access, a data breach that involves the card details or a pattern of spending that is unusual The card may be flagged for security purposes.

Identity Verification Issues- Challenges in verifying the cardholder's identity when making transactions, particularly when additional verification is required, could cause the card to be temporarily suspended.

Card Stolen or Lost - If you report the loss or theft of your card the card issuer will stop access to the card until a replacement is issued.

Suspicious activity indicators- Any behavior, or activity, related to the card that raises suspicions (such as multiple declined transactions or geographic anomalies) or any other unusual spending pattern could trigger an immediate ban.

If a credit card is placed on a "blacklist", the cardholder might not be able make use of credit or their credit card until the issuer has confirmed the validity of the card or resolved any concerns about security or fraud. It is crucial that the cardholder to contact the issuer of the card quickly to resolve any issues, check transactions and resolve potential security concerns.

What Is The Minimum Qualification For A Person To Run The Credit Card Number On A List App?

Professionals who are authorized in financial institutions, law-enforcement agencies, and cybersecurity firms are typically responsible for confirming credit card numbers or checking suspicious activity associated with credit cards. They include Fraud Analysts, who are specially trained employees of financial institutions who specialize in identifying fraudulent activities associated with credit cards and investigating the issue. They utilize specific software and tools to identify patterns, anomalies, and possibly compromised card information.

Cybersecurity Experts- Experts who specialize in cybersecurity, particularly the monitoring and detection of cyber dangers, including compromised credit card information. They can prevent data breaches, examine data for signs that it's been hacked and take security measures.

Law enforcement officers Individuals or units within the law enforcement agencies that specialize in financial crimes, such as fraud with credit cards. They have access to resources and databases to track and analyze fraudulent activity.

Compliance Officers: Experts who ensure that banks and financial institutions adhere to rules and laws governing financial transactions. They can supervise processes to identify and report any suspicious transactions involving credit cards.

Databases that contain credit card blacklists and the authority for validating credit card numbers against these lists are strictly regulated. This requires proper legal authorization.

The teams and individuals who are certified employ specific software, protocols, and legal processes to check credit card details against blacklists while adhering to the strictest security and privacy regulations. It's essential to rely on authorized professionals and institutions when you have concerns regarding the possibility of compromising credit card information. Inadvertent attempts at accessing or using blacklists for credit cards could lead to legal consequences. Have a look at the recommended savastan0 login for more recommendations.